When it comes to credit card applications, there’s tremendous upside to making some of your applications business card applications.

You may not think that you qualify for a “business” credit card, but I would guess that you actually do.

Within the realm of credit card applications, owning a business doesn’t mean you necessarily have a registered business. It doesn’t mean you have employees. And it certainly doesn’t mean that you’ve made a significant income at your business.

There is a broad definition of what qualifies as a “business” for credit card purposes. If you do any coaching, consulting, babysitting, selling on ebay or etsy, etc., refereeing, tutoring, the list goes on…

How to Apply for a Business Credit Card

When you apply for your business credit card you should simply and honestly report your business income to date, and you also record your personal income. Both of these factors will be taken into account when the credit card company decides whether or not you’re creditworthy.

The business card will be secured with your personal credit score. So your business’ creditworthiness is essentially your own creditworthiness.

As an example I currently have two businesses. One was a Pizza catering business that has yet to turn a profit. And the other was my personal finance website.

When you apply for cards you should be honest about past revenue but optimistic about future revenues, and forceful about your need to have a business line of credit to keep business and personal expenses separate, and persuasive about the crucial need for the credit card to successfully launch your venture .

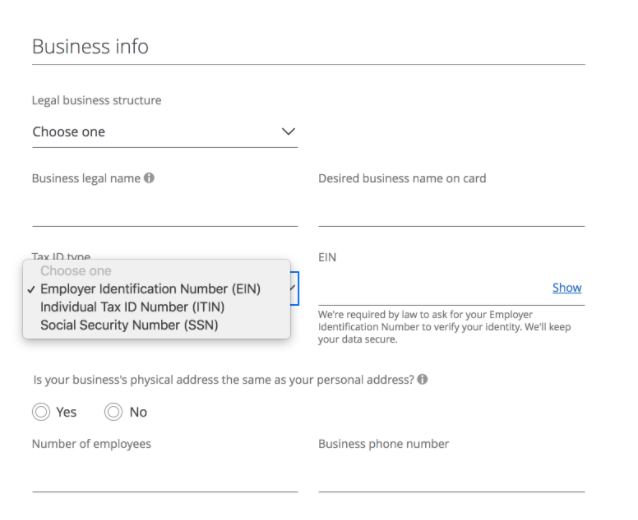

You should report the business as a sole-proprietorship and use your Social Security number as the tax ID number on the application.

The application will ask you for an EIN, but you can still enter your SSN.

So why bother applying for business credit cards for a business that is not yet profitable in the first place?

- First, if you have a business, you can apply for business credit cards and earn more miles & points! This is particularly useful because all credit card companies were not created equal. Currently Chase blows the other credit card companies out of the water in terms of the quality, quantity, and variety of their products, both business and personal.

- Some of the best cards out there are business cards. My favorite business card to use is the Chase Ink Business Preferred Credit Card, both for its generous sign up bonus, its incredible spending bonuses, and for the access it allows to the excellent Ultimate Rewards online shopping portal. Chase also has business versions of popular airline cards from Southwest and United, Amex has the Delta business as well as Gold and Platinum cards, Citibank has an AA business card and Capital One has a number of attractive business credit cards. Simply put, saying no to business cards leaves a lot of miles on the table.

- Though your business card application will be reflected on your personal credit report with a hard credit inquiry, your credit utilization ratio will not be affected by subsequent business card spending. As previously discussed, the credit utilization ratio is one of the most important factors in determining your credit score. So business cards are a great resource for making big purchases that might otherwise negatively impact your score.

- Business cards often have excellent protections such as car rental collision coverage, extended warranties, and travel insurance.

- There are other business card specific perks such as lounge access, rental car discounts etc.

So the take home here is that this is America and you too can be (and probably already are) an entrepreneur in some way. You can proudly claim the mantle of a business owner and I’m sure that if you do so, you will find your new identity as a business owner highly rewarding.