We want to welcome Michael from The Honeymoon Guy, who is here for a post sharing his thoughts on extending the expiration date of your miles and points.

We want to welcome Michael from The Honeymoon Guy, who is here for a post sharing his thoughts on extending the expiration date of your miles and points.

This is an essential topic as expiration is always something you need to be mindful of, and Michael did a fantastic job of giving you 14 different ways to keep your miles & points from expiring

How to Prevent Your Miles and Points from Expiring

If you want to redeem miles you first have to earn the miles. That’s key of course. But there’s another aspect to the game – you have to prevent your acquired miles and points from expiring before you get a chance to use them. The good news is that there are many quick and easy ways to do so.

To avoid expiration of miles/points, you generally need to have some sort of activity in your frequent flyer/hotel loyalty program within a certain period of time (usually between 12 and 24 months).

For example, here’s the text from American Airlines FAQ:

How can I keep my [AAdvantage] miles from expiring?

Just earn or redeem miles on American or with an AAdvantage partner at least once every 18 months. We’ll automatically extend your mileage expiration date 18 months from the date of your most recent activity.

Your account summary shows the number of miles you have and the earliest date they could expire.

As is the case with American Airlines, mile- and point-extending activity can usually take one of two primary forms:

- Earning more miles/points

- Using/redeeming miles/points

The third, less common avenue: In some cases your miles/points will be remain active as long as you hold the airline’s or hotel’s co-branded credit card, even if you don’t have earning or redeeming activity.

Before we dive into the quick and easy ways to keep miles/points active, let’s take a look at…

Expiration Policies

I’ve included here a list of the expiration timelines for some popular airlines and hotel brands. Click the links for details as there are some nuances with some programs.

Select US-Based Airlines

- American Airlines AAdvantage – 18 months

- Delta Airlines SkyMiles – None (miles do not expire)

- JetBlue TrueBlue – None (miles do not expire)

- Southwest Rapid Rewards – 24 months (requires earning activity)

- United Airlines MileagePlus – None (miles do not expire)

Now, let’s take a closer look at…

Earning Miles

You can keep the miles/points in almost any frequent flyer or hotel loyalty program active by earning miles or points in that account. There are many, many ways to earn small (or large) amounts of miles/points in an effort to “reset the clock” on the miles/points in your account…

1. Be Selective For Your Next Flight or Hotel Stay

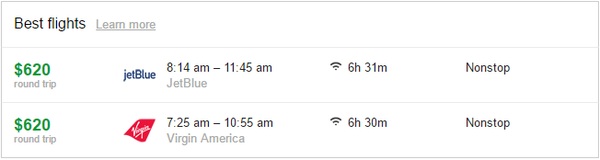

Obviously you’re not going to fly a $700 fare simply to keep a few thousand frequent flyer miles active. However, it may be worth flying with one airline over another if it means you’ll prevent a stash of miles from expiring.

Many times airlines match fare pricing for a given itinerary. So for example, it may be the same $449 price for an itinerary whether you fly Delta, American or United. If you’re going to be taking that trip and you have a few thousand miles nearing expiration in your United account, you may want to go ahead and book the flight on United instead of another airline.

If you have multiple flight options for a similar price, consider booking with the airline for which your miles are close to expiring. The earned miles from your flight will prevent your existing miles stash from expiring.

The same sort of logic applies for hotel stays as well.

2. Shop Through An Airline or Hotel Portal

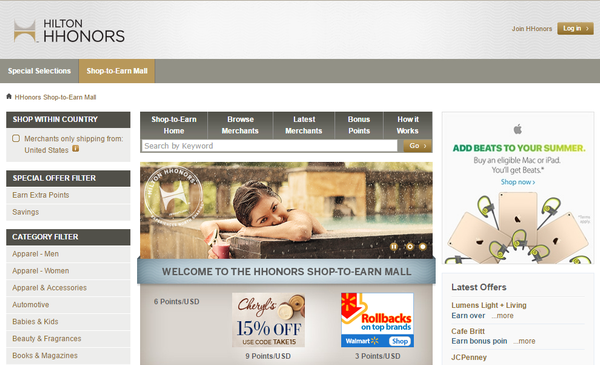

One of the simplest ways to earn a small amount of miles cheaply and without much effort is to make a purchase through an airline’s or hotel’s shopping portal. Shopping portals are basically just referral sites which you click through. When you do so, and make a purchase, you’ll earn miles or points in that airline’s/hotel’s program.

Here are a few examples of airline/hotel shopping portals:

- United’s MileagePlus Shopping Mall

- Hilton HHonors Shop to Earn Mall

- Southwest Rapid Rewards Shopping

Shopping portals run by airlines and hotels enable members to easily earn frequent flyer miles or hotel points when making online purchases.

3. Feed Your Stomach and Your Account With a Dining Rewards Program

Earn points while dining out and keep your existing frequent flyer miles from expiring! Click the image to sign up for the American Airlines AAdvantage dining program.

Many airlines, and a couple hotel brands, participate in a dining rewards network. The program enables you to earn miles or points when you dine at a participating restaurant and use a credit card (which you’ve pre-registered in the program) for payment. In general, the number of miles/points you earn is proportional to the amount of money you spend.

Here’s a list, with links, of participating airlines:

You can literally buy a soft drink at a participating restaurant and get a couple miles added to the corresponding frequent flyer or hotel loyalty account (as long as you use for payment the credit card you registered with that program).

Making this option even better is the fact that you can have accounts with the various dining networks. You can’t earn points or miles in multiple programs for the same dining purchase but you could earn miles in the AAdvantage program for one dine and the Spirit program for the next dine. If you’re looking to earn more than a few miles or points immediately you can “time shift” your dining purchase by buying a gift card at the restaurant and then using that across future dines.

4. Drive Up Your Account Balance With a Car Rental

Renting a car with most major companies can yield you airline miles or hotel points. For example, renting from Avis will get you miles in your frequent flyer program of choice, from Aer Lingus to Virgin Atlantic and almost every airline in between (over 60 airlines, as of writing!). If you’re looking for hotel points, an Avis rental has you covered there for properties and chains including the ARIA Resort and Casino, Hilton, Starwood, Wyndham and many more.

5. Get Points or Miles, or Both, From a Hotel Stay

You probably already know that you can earn points in a hotel loyalty program when you stay at a hotel. What’s less well known is that you can sometimes get miles in an airline program for a hotel stay and with some hotel brands, such as Hilton, you can actually get both!

6. Make a Small Purchase w/ Co-branded Credit Card

If you have a credit card that is co-branded with an airline or hotel, making a purchase, even one as small as a bag of candy, will get you miles/points that count as mile- or point-extending activity for most programs.

If you get a co-branded credit card that comes with a signup bonus, in almost all cases the deposit of those signup bonus miles/points into your account will count as expiration-extending activity. Since most signup bonuses are only awarded these days after a minimum amount of spending is performed, you’ll be covered both ways.

7. Complete a Survey or Watch Ads

If you’re the type that is stuck to their computer many hours a day, perhaps you should replace some of your endless browsing of Buzzfeed or Reddit with a few minute session on a survey or ad site. You can earn miles or points doing so. As always, double-check the expiration policy of the frequent flyer or hotel loyalty program of interest to make sure miles or points earned this way will extend the expiration date of existing miles or points.

Survey/ad companies that pay out miles or points include e-Miles (through their Miles for Minutes program), e-Rewards and OpinionMilesClub, which earns United MileagePlus miles.

8. Transfer Points Into Your Account

Many airlines and hotel brands partner with other programs, such as Chase’s Ultimate Rewards and American Express’ Membership Rewards. If you have points in those bank programs, you may be able to transfer them into your frequent flyer or hotel loyalty account and extend the expiration date of existing miles or points.

American Express’ travel transfer partners include Aeroplan, British Airways, Delta, Hilton, and others.

9. Buy Miles or Points, as a Last Resort

With all the other ways listed here to earn miles quickly and easily, buying miles or points should be a last resort option. There are two reasons: a) airlines and hotels generally sell miles and points at a bad price and b) there is usually a minimum purchase requirement (and sometimes a set fee) that forces you to purchase many more miles or points than the single mile/point you need.

However, if you’re really in a bind in terms of timing, buying miles or points could be your best bet, as a purchase of miles/points will usually be completed instantaneously or close to it.

Redeem Miles

As the expiration policy list above shows, most mile and point stashes will have expiration dates extended not just with earning activity but also with redeeming activity (one notable exception is Southwest Airlines). For those programs it is worthwhile to redeem a very small number of miles or points to extend the validity of a large balance of miles or points.

Here are some quick and easy ways to do so!

10. Redeem for hotel night or flight

The main reason you’re probably acquiring frequent flyer or hotel loyalty miles/points is to get free flights or hotel stays. Well redeeming for a free flight or hotel stay also counts as mile- or point-extending activity for most programs.

If your miles or points will be expiring soon and you know you’ll be taking a trip in the future, stop procrastinating and book your award flight or stay. You’ll get that task off your to-do list and it will extend the expiration date of the balance of your miles or points (for most programs).

Most hotel award redemptions are also fully refundable so in such cases there is really no risk to making a speculative award booking. Even if you end up canceling the award booking at a later date, it will still count as mile- or point-extending activity.

If you’re making a speculative booking that you’re likely to cancel, double-check cancellation policies (so that you don’t get charged) and whether the specific program of interest will count a booking/cancellation combo as mile- or point-extending activity. For the latter, you could always do a trial where you both book and cancel well before the current expiration date of your account, to confirm that expiration date is extended.

11. Donate to Charity

This is the most philanthropic option – help others in need and extend the expiration date on your remaining miles or points! Various airlines and hotel brands offer donation options, including United and Hilton. Minimum donation amounts vary though so be sure to check the rules. After all, donating 4,000 points from an account with only 6,000 points probably isn’t your best bet if your goal is really just to extend expiration.

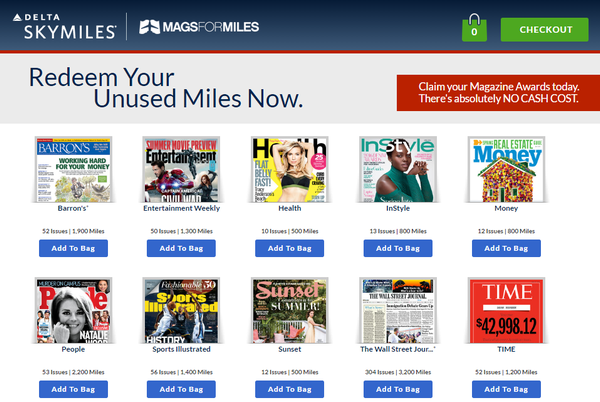

12. Subscribe to a Magazine

With the popularity of the internet it seems that print magazines have waned in popularity. That’s led to low subscription prices. Instead of paying cash you can actually redeem miles or points for magazines and because the cash subscription prices are so low, the mileage redemption rates are very reasonable also!

Want to extend the expiration date of your miles or points and get some reading material as well? Consider redeeming a small chunk of miles or points for a magazine subscription.

Mags for Points is one of the most well-known magazine marts for travelers. On the airline side, they work with Alaska, American, Delta, Frontier, Hawaiian, JetBlue, Spirit and United. Participating hotel brands include Choice, Hilton, La Quinta and Voila.

I’ve seen redemption rates as low as 100 miles for a one-year subscription. Granted, that is for a magazine that would most likely be complimentary in a store rack. It’s almost as if those low-mileage redemptions are offered just for the purpose of generating account activity!

13. Transfer Miles or Points to a Family Member

Though it’s rare to be able to transfer points or miles to friends or acquaintances, many programs do allow the transfer of miles or points to a family member (sometimes it must be a spouse or partner).

Hyatt handles transfers a somewhat uniquely – they allow any two members to combine a desired number of points into one account to enable a redemption. This is limited to once every 30 days but there isn’t a restriction on the relationship of the two persons.

14. Transfer Miles or Points to an Airline or Hotel

Many frequent flyer and hotel loyalty programs offer transfer of points or miles to other programs.

If you’re sitting on some hotel points or frequent flyer miles that will soon expire, consider transferring a small number of them to another travel partner. If the minimum required transfer amount isn’t high, then it’s a great option to pursue.

With all of the ways I’ve highlighted here to earn or redeem a small amount of miles/points quickly and easily, you should never have a significant mileage or point collection expire!

However…

Is There a Time to Let it Go?

First of all, get that Frozen song out of your head. Though the rest of this post is full of tips to prevent points from expiring, there are times you should willingly bid points or miles adieu. Any time or energy you spend trying to save one set of miles or points is time you don’t have for other ventures.

Now, this sort of thinking only applies in some very specific cases. For example, if months ago you acquired some small amount (say 250) of miles in the frequent flyer program of an obscure airline that doesn’t really fly to/from your home airport, it’s probably not worth the time or effort to try to save those miles.

So where do you draw the line? Of course that depends on the specifics of your situation but in a general sense, I would say it’s not likely worth the time or effort to prevent miles or points from expiring if you have less than 1,000 of them in the account.

Closing Notes

I have listed many different ways to keep your miles and points active. Most will only take a few minutes of your time and some are related to activities that you’ll be doing anyway (e.g. eating) and thus won’t cost you anything.

One important reminder: Make sure you don’t wait until the proverbial last minute to perform a mile- or point-extending activity. As is all-too-common these days, some of these activities come with the “6 to 8 week to post” fine print. It won’t usually take that long but you don’t want to be sweating it out, so track your accounts and perform a point- or mile-extending activity about two months before the expiration date so you aren’t cutting it close. If you’re really in a bind you may want to look for an instant redemption or to buy some miles or points.

You can track your accounts manually or with a tool/website such as AwardWallet.

Good luck!

What is your preferred method of keeping points or miles active? Have one I didn’t highlight here? Share it in the comments below!

Michael, aka The Honeymoon Guy, created his site to help readers realize champagne travel on a beer budget. He started the site after he and his wife took a 24-day around-the-world honeymoon, with stops in Hawaii, Tokyo, the Philippines and South Africa, all for the price of a simple week-long vacation. Though his site is focused on honeymoons to an extent, the majority of the tips, guidance and methods Michael shares are helpful to all travelers.

Michael, aka The Honeymoon Guy, created his site to help readers realize champagne travel on a beer budget. He started the site after he and his wife took a 24-day around-the-world honeymoon, with stops in Hawaii, Tokyo, the Philippines and South Africa, all for the price of a simple week-long vacation. Though his site is focused on honeymoons to an extent, the majority of the tips, guidance and methods Michael shares are helpful to all travelers.